Have you been thinking about purchasing a home recently, but were disappointed when you heard that interest rates were climbing? Don’t let that discourage you!

Interest rates may be slowly increasing, but they still haven’t increased higher than past decades. Throughout the pandemic, mortgage rates were at an all-time low but at some point they needed to be increased again. We are now seeing a slow increase in mortgage rates, but buying a home is still much more affordable than it was in past decades.

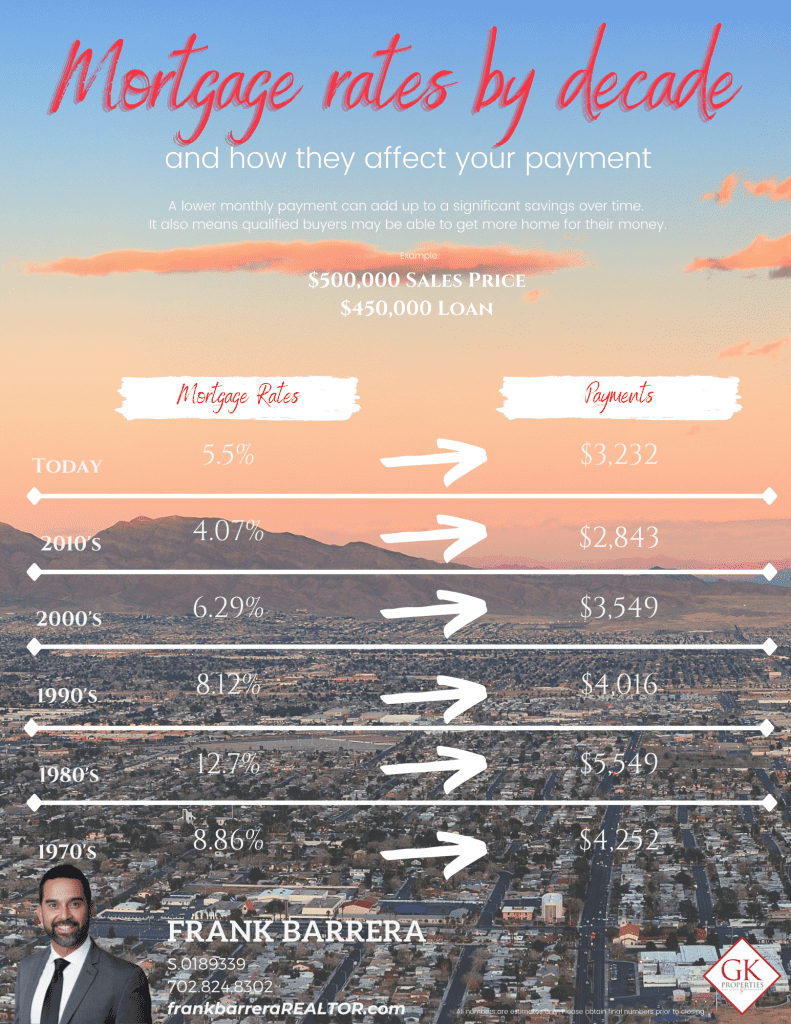

Check out the infographic below that shows the average interest rate of past decades compared to the average interest rate today. As you can see, the highest average interest rate was in the 80s at 12.7%, making the average mortgage payment for a $500,000 home $5,549. If you compare that interest rate to today, the average interest rate is 5.5%, and the average mortgage payment is $3,232 on a $500,000 home. The average mortgage payment for a $500k home is a 42% decrease from the average mortgage payment in the 80s.

So why aren’t you locking in a low interest rate now? Knowing that interest rates are climbing, lock in the rate now before they continue to climb and you are no longer able to qualify for a mortgage.