Inflation is on the rise, causing prices for everyday items to increase. Most people are feeling this shift, and the climb in consumer costs is causing consumers to have less in their pockets at the end of the month.

Homeownership can be a daunting step for someone that has been renting, but with homeownership, also comes fixed monthly mortgage payments. Renters do not have this same benefit. With inflation causing prices to go up, monthly rental prices will also continue to move with the market.

With a mortgage payment, homeowners are able to set their monthly payment for 15 or 30 years with a fixed mortgage loan without it ever changing. Renters do not have the same certainty.

Now you may still be asking, should I purchase now?

The biggest question is, do you want to invest in something long-term?

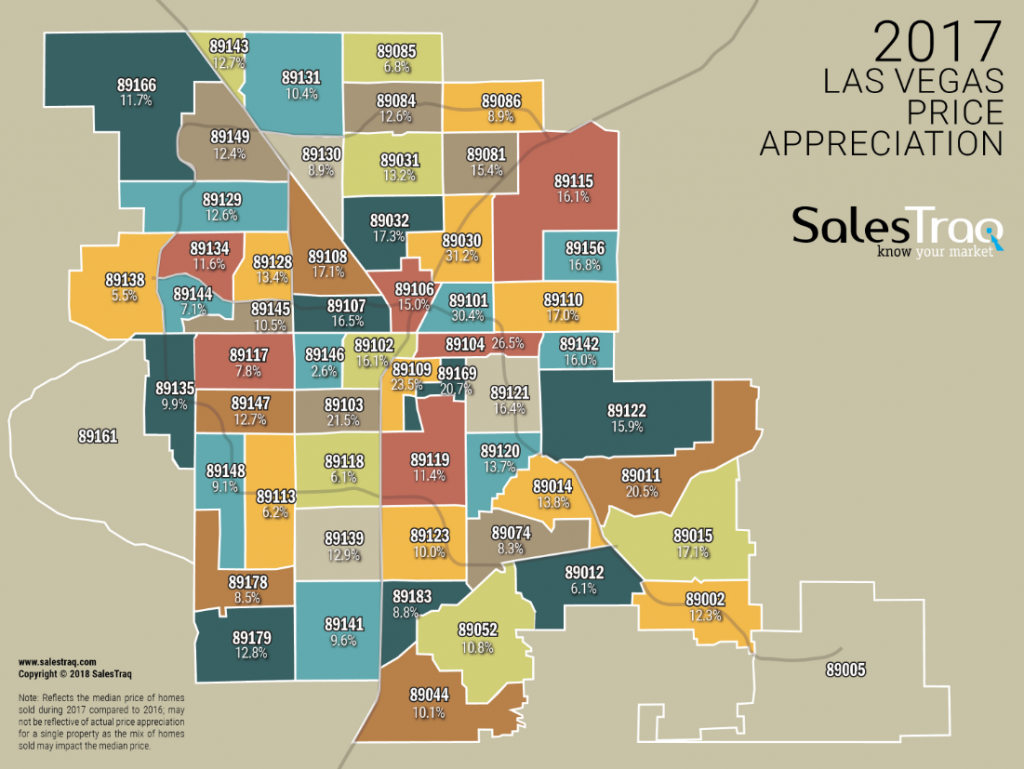

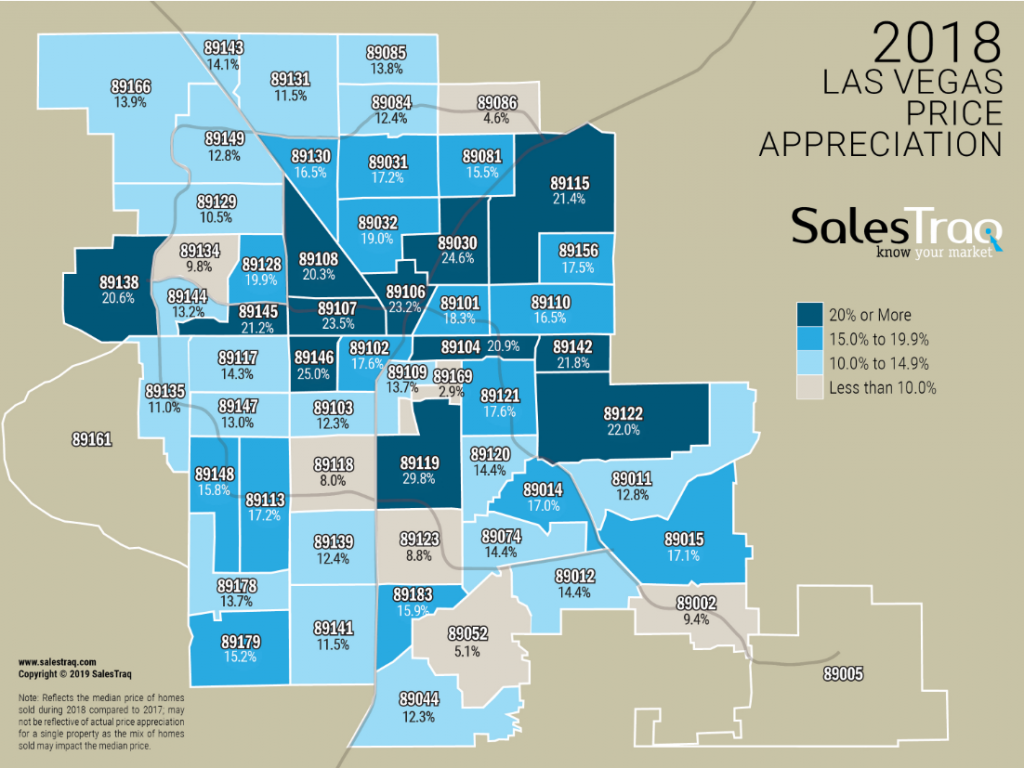

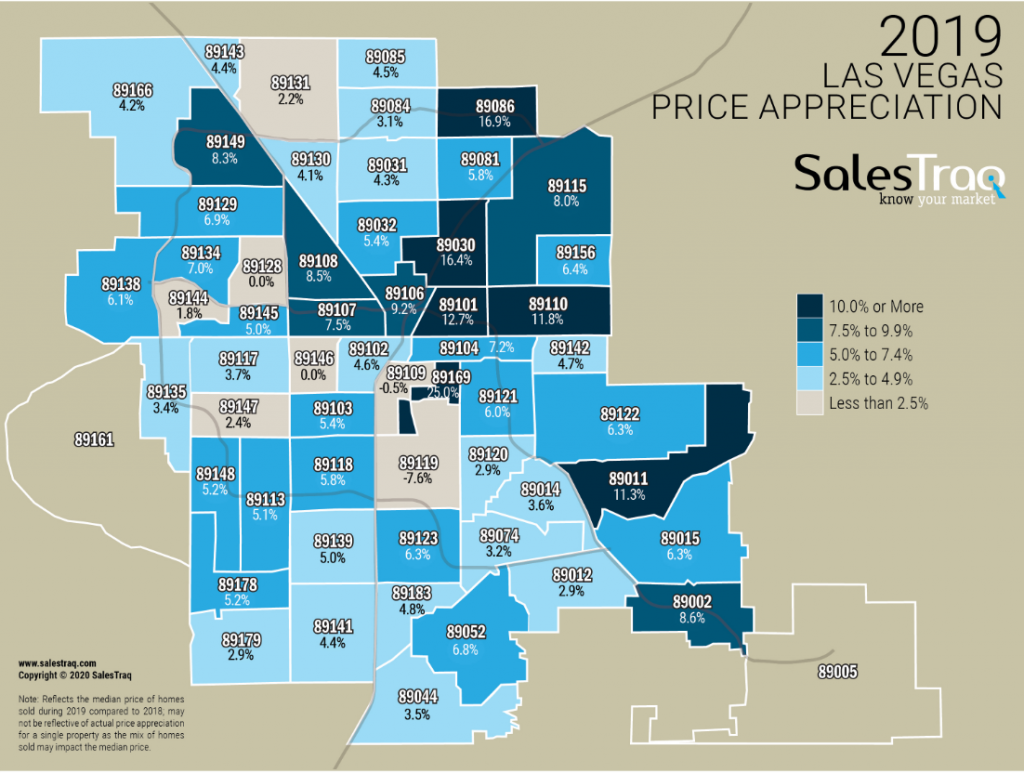

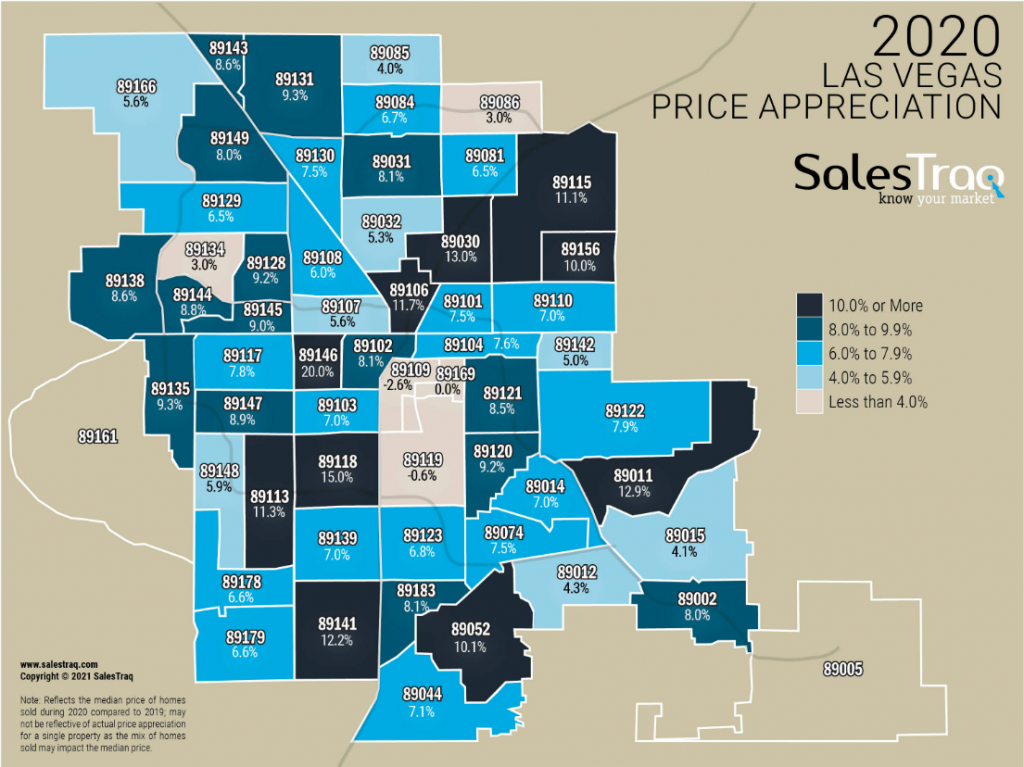

While home prices are always fluctuating, purchasing a home will provide you with the opportunity for long-term financial growth. In inflationary times, home values increase which increases homeowners equity and net worth. Homes tend to appreciate in value, meaning you shouldn’t have to worry about losing money with this investment.

Experts are forecasting a continuation of this price growth in homes for the next few years, so why wait to start building your net worth? Purchasing a home in Las Vegas can be a great investment, so call me today to see if now is the right time to purchase with your specific situation!